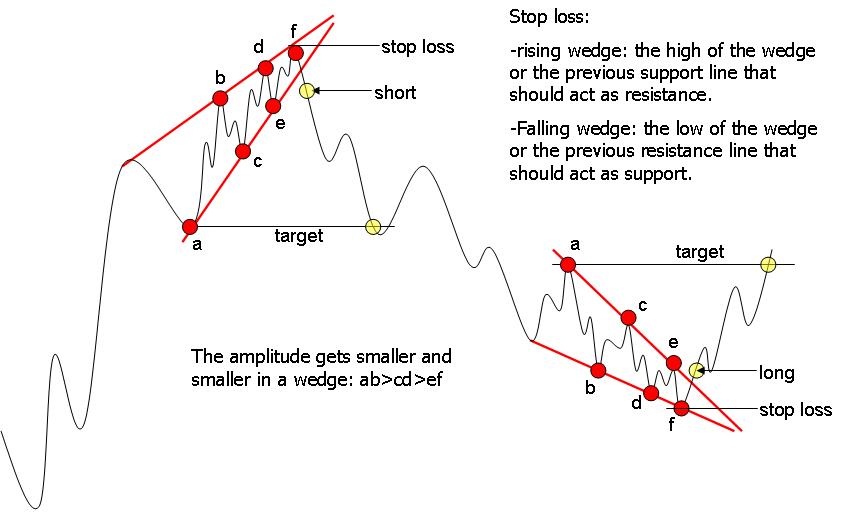

This tends to occur with wedges because the price is still rising or falling, but with smaller and smaller price waves. Rising wedge example: Russell 2000ĭivergence occurs when the price is moving in one direction, but the oscillator is moving in the other. You can know whether the trend will continue or reverse depending on the location of the rising wedge. But generally, the prices break out in the reverse direction from the trend line. However, this leads to the breaking of the price from the upper or the lower trend line. The Falling Wedge is a bullish pattern that begins wide at the top and contracts at the bottom.īut before the lines converge, sellers arrive at the coins market, and consequently, the rise in prices begins to lose their momentum. Otherwise, place the stop-loss at breakeven and wait for the market to hit the take-profit. If the price action came back to the breakeven, only then we suggest you close your position. This is normal, and while trading this pattern, we will face these types of situations. Falling wedges they mostly complete after a sharp slump in prices and are bullish.

I like wedges, i mainly trade them on the d1 or weekly charts though as i find on the hourly too fast for my liking and i hate being at the screen waiting for something to happen. A major decline in volume as the price action progresses through the pattern. If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, signup for ourNewsletter. Upper and lower trend lines must have at least 3 to 4 higher highs and higher lows to consider that as a Rising Wedge pattern. This pattern typically appears in an uptrend, and on higher timeframes, it takes nearly 3 to 6 months of time to form. The Rising Wedge is a bearish trading pattern that begins with a wide bottom. Although both patterns serve the same function but mostly ascending triangle is considered more of a trend continuation, the rising wedge is thought of as a reversal pattern.

The price will eventually breakout and the trend will follow that direction, either an upward or downward movement.

#Falling and rising wedge pattern how to#

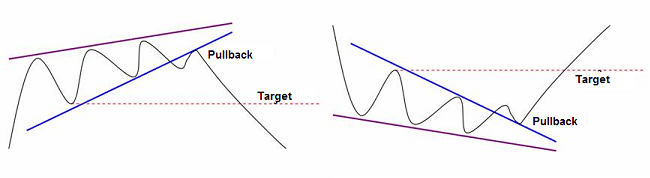

The target for the trade is then calculated by measuring the distance from the highest peak on the pattern to the lowest trough, projected upward from the beak point. The buy point they will commonly use is the breakpoint of the upper resistance line as this is seen as a potential confirmation that the downtrend is reversing. As this is the case when traders see this pattern occur in a downtrend they commonly look to trade a reversal of that downtrend so they are looking for buying opportunities.

In this lesson we are going to learn a trading strategy traders of the stock, futures, and forex markets commonly use to trade these chart patterns.Īs you hopefully remember from our last lesson when a falling wedge appears in a downtrend it is considered a reversal pattern. In our last lesson we learned about the falling wedge and the rising wedge patterns, two chart patterns which can be seen as reversal or continuation patterns depending on whether they appear in an uptrend or a downtrend.

0 kommentar(er)

0 kommentar(er)